501c3 Things To Know Before You Get This

Table of ContentsIrs Nonprofit Search Things To Know Before You BuyWhat Does Non Profit Org Do?The 8-Second Trick For Google For NonprofitsAll About Google For NonprofitsThe Basic Principles Of 501c3 The 20-Second Trick For Not For Profit Organisation

While it is safe to claim that the majority of charitable companies are honorable, companies can certainly experience from a few of the exact same corruption that exists in the for-profit business globe - non profit org. The Blog post located that, between 2008 and also 2012, greater than 1,000 nonprofit companies inspected a box on their internal revenue service Type 990, the tax return form for exempt organizations, that they had experienced a "diversion" of possessions, meaning embezzlement or other fraudulence.4 million from purchases linked to a sham business started by a previous assistant vice president at the organization. Another instance is Georgetown University, who experienced a considerable loss by a manager that paid himself $390,000 in additional payment from a secret savings account formerly unidentified to the university. According to federal government auditors, these stories are all also typical, as well as work as cautionary tales for those that strive to create and also operate a charitable organization.

When it comes to the HMOs, while their "promo of health for the advantage of the community" was considered a charitable purpose, the court determined they did not run primarily to profit the community by supplying health solutions "plus" something extra to benefit the area. Hence, the abrogation of their excluded status was upheld.

The 6-Minute Rule for Google For Nonprofits

In addition, there was an "overriding federal government rate of interest" in banning racial discrimination that outweighed the school's right to free exercise of religious beliefs in this way. 501(c)( 5) Organizations are organized labor and also farming as well as horticultural associations. Organized labor are companies that create when employees associate to engage in collective negotiating with an employer concerning to salaries and also benefits.

By contrast, 501(c)( 10) organizations do not offer payment of insurance coverage benefits to its participants, therefore may prepare with an insurer to provide optional insurance without jeopardizing its tax-exempt status.Credit unions and various other shared economic organizations are identified under 501(c)( 14) of the internal revenue service code, as well as, as part of the financial sector, are heavily controlled.

Non Profit Organizations List Fundamentals Explained

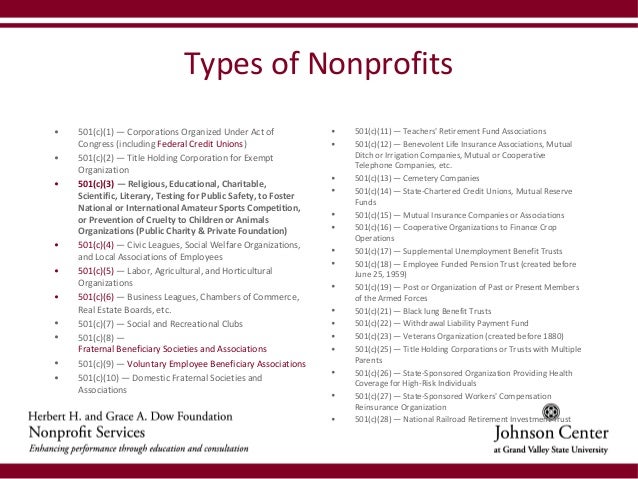

Getty Images/Halfpoint If you're taking into consideration beginning a nonprofit organization, you'll want to understand the various kinds of not-for-profit classifications. Each classification has their own requirements as well as compliances. Right here are the kinds of nonprofit designations to assist you decide which is right for your company. What is a not-for-profit? A not-for-profit is an organization operating to enhance a social reason or support a common mission.

Gives repayment click reference or insurance coverage to their members upon health issues or various other traumatic life occasions. Subscription should be within the very same work environment or union.

g., over the Web), even if the not-for-profit does not directly obtain donations from that state. On top of that, the IRS needs disclosure of all states in which a not-for-profit is registered on Form 990 if the not-for-profit has income of more than $25,000 each year. Charges for failing to sign up can include being compelled to repay donations or dealing with criminal costs.

What Does Non Profit Organizations Near Me Mean?

com can assist you in registering in those states in which you mean to get donations. A not-for-profit organization that gets considerable portions of its revenue either from governmental resources or from direct contributions from the public may certify as an openly sustained company under area 509(a) of the Internal Revenue Code.

Due to the intricacy of the regulations as well as guidelines controling classification as a publicly supported company, include. A lot of individuals or teams create not-for-profit companies in the state in which they will mainly operate.

A not-for-profit firm with service places in numerous states may form in a single state, then register to do organization in other states. This implies that nonprofit corporations must officially register, submit yearly records, and pay yearly costs in every state in which they carry out company. State laws call for all not-for-profit companies to maintain a registered address with the Assistant of State in each state where they operate.

More About Non Profit Organization Examples

Area 501(c)( 3) philanthropic organizations may not interfere in political projects or perform substantial lobbying activities. Get Homepage in touch with an attorney for even more details information regarding your organization. Some states only require one director, however the bulk of states call for a minimum of 3 directors.

Nonprofit firms, in contrast to their name, can make an earnings however can not be created primarily for profit-making., have you thought about arranging your venture as a nonprofit firm?

Excitement About 501c3 Nonprofit

With a nonprofit, any kind of cash that's left after the company has actually paid its expenses is placed back into the organization. Some kinds of nonprofits can obtain payments that are tax obligation insurance deductible to the person who adds to the company.